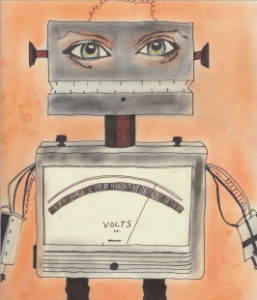

High-Frequency Trading and the Robot-Led Holocaust

Addendum (Low-Frequency Updates on High-Frequency Trading (HFT))

1. There’s no real contradiction between asserting that at best, HFT creates essentially zero benefit (because the value of getting prices right a millisecond earlier is approximately zero) and that at worst, it actually increases volatility.

2. (a) “Even if the practice has no gain, I suspect the loss is small.” That depends on what you mean by small. If the practice has no gain, the social loss is easy to estimate: it’s the opportunity cost of the resources used. What’s the value of all those brilliant minds, computer capital, and other inputs? Probably in the billions. (b) “On an actual list of bad policies or practices in our world, would it be in the top million?” Well, you’re the one who’s blogging about it repeatedly. Is billions in social loss more important than the cost of a zoo killing a gorilla? Probably.

3. “There is no argument to date, and probably no argument period, that HFT can lead to financial insolvency or collapse on a major scale.” That’s setting the bar pretty low…

5. “We should still follow the rule of regulating practices shown to be harmful or likely to be harmful.” Actually, Michael Wellman’s proposal in the comments and on his blog seem like the best approach. Financial markets don’t just spring from the forehead of Adam Smith, they are consciously DESIGNED by humans seeking to achieve specific goals. If a small change to the mechanism for matching buyers and sellers drastically reduces rent dissipation, then that design should be implemented.

Specifically, Wellman’s suggestion of clearing markets once per second (or some similar discrete interval) would seem to do the trick by eliminating most of the incentive for microsecond improvements in trading algorithms, software and hardware. As long as we’re going to design mechanisms for trading, we may as well design and implement efficient ones.

Michael Wellman and Kevin Lochner have also followed up with new posts on this: Wellman on the technology behind HFT and Lochner on Call Markets.